Statistics often mask a reality that is more complex than the numbers. The US has been in recovery for over a year, yet most Americans will tell you that it feels as if it has not even started. In Canada, our recession was the mildest of all the industrialized nations yet our mindset is still influenced by the slow recovery of our southern neighbour. Economists in both countries have said that employment growth is the key to sustaining the recovery; consumer confidence and, eventually, consumer spending must be strengthened via income growth overall. Those who are already employed need to have more disposable income in order to increase household spending and those who successfully return to the workforce must re-initiate their normal spending levels. Increased consumer spending and confidence are self-re-enforcing and given that consumer spending is now 65% of all North American economic activity, there can be no sustained recovery without a growing workforce.

Throughout 2010 most corporations rebuilt their profitability without rehiring workers, seeking profits through higher productivity. That trick has to come to an end as eventually companies realize that they need to expand their workforces to sustain the supply of good and services. We finally saw companies start hiring in earnest in the last quarter and now both the US and Canadian economies are creating jobs consistent with their long term monthly averages.

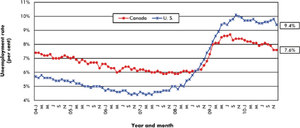

The U.S. has a lot of catching up to do – they lost over 8 million jobs during their two year recession and have only added back just over 1 million workers. Canada, in contrast, lost only 400,000 jobs during its 9 month recession and has added back almost all of those. Indeed, Canada is poised to outstrip the U.S. in relative job growth in 2011.

Exhibit 1: Canada vs. U.S. monthly unemployment rate (percent) seasonally adjusted data

Data sources (seasonally adjusted): Statistics Canada and U.S. Bureau of Labor Statistics

(Department of Labor). / Chart: CanaData - Reed Construction Data.

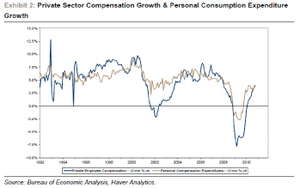

For full-time workers the only way to increase their spending power is via wage hikes, and exhibit 2 looks at the relationship between U.S. wage increases and spending growth over nearly 20 years. The correlation is remarkable; with 4% real wage growth in 2010, there is more income available to be spent – but that money may be sucked up by expenditures that do not promote economic growth. Consumers are facing a host of attacks on their pocketbooks for basic staples of a typical North American existence that could dampen disposable income and therefore slow growth in 2011.

Here are the major economic headwinds of 2011 facing North America:

1)Record prices for basic foodstuffs: The United Nation’s Food and Agriculture Organization reported in early January that food prices have spiked to their highest nominal levels since 1990, exceeding the previous high set in 2008. Food prices are at record levels in 61 countries, and a return to food riots is a virtual certainty in the developing world in countries where current government subsidies are unsustainable. For the North American consumer, foods made with wheat, rice, corn and sugar are going up, as are other staples like coffee. Consumers may end up having to spend what they thought was discretionary income on the basic necessities of their daily existence.

2)Sustained higher oil prices: While we may not see the record $145 per barrel price of late 2008, it is likely that a $100 barrel will translate into $4 per gallon gas across many regions of the US and sustain $1.30 per litre in Canada. Those who recall the onset of the financial crisis in October 2008 will remember that it coincided with record high gas prices, leading many who were faced with refinancing their homes at that time with the stark choice of either paying their mortgage or gassing up the car to go to work. Oil is also an important factor in food transportation and therefore has a double effect on consumers – in their cars and at the dinner table. If consumers spend their extra income on transportation, then they cannot spend it at Wal-Mart or Target.

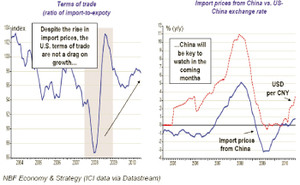

3)Chinese Yuan appreciation: Referring to Wal-Mart and Target, a lot of those products from toys to knock-down furniture come to us from China. Consumers have benefitted from almost 30 years of falling prices on a wide range of goods due to the ever-increasing economies of scale afforded to us via Chinese industrialization. In short, the Chinese made itcheaper and the savings were passed on to us; we bought these goods with debt and then the Chinese invested their profits in the debt that we issued to them. It was a good game until our debt got out of hand and now the goods are going to get more expensive. Some economists estimate that the Yuan is undervalued by up to 40%; most agree that an appreciation of at least 20% is inevitable in order to address significant international trade imbalances that have been created by having the Yuan linked to a falling US Dollar. Referring to the two graphs representingthe US-Chinese trading relationship, Chinese exports to the US have recovered but the rising value of the Yuan is an increasing threat to prices. After falling during the recession, Chinese prices are rising not only because of gradual Yuan appreciation but also because of inflationary pressures (wages and input costs) within the Chinese economy. The era of cheap Chinese manufacturing is coming to an end due to internal structural changes in their economy and the effect will be amplified by a rising Yuan, forcing consumers to suddenly start paying more for goods for which they received only price cuts in previous years.

4) Taxes, taxes, taxes: At least 10 US states and one Canadian province (Ontario) are in such dire fiscal shape that taxes will have to rise substantially to fill the deficit gap. Illinois was one of the first to take the plunge by hiking the state tax rate from 3% to 5% to fill an expected deficit of 40% of their state budget. Measures such as these will become the norm as states slash spending and raise revenues to compensate for the massive compression of their tax bases following the recession. Ontario’s go-slow attitude towards reducing its $20 billion CAD annual deficits is going to make it the top debtor province before long and will make Quebec look like a fiscal tightwad – their taxes are going up as well, but not before this year’s provincial election. Employers will increase salaries only to see those extra funds transferred to the local authorities. Note that this scenario does not consider the tax deal recently concluded in the US Congress that maintains the Bush-era tax cuts for two more years with no significant spending reductions – that game will also come to an end soon, and Americans will start to pay to close the federal deficit as well.

5)An international crisis ignored so far – Pakistan: Not enough people are talking about the assassination of Punjab provincial governor SalmanTaseer who opposed his country’s radical anti-blasphemy laws, which made him a liberal politician in an increasingly radicalized society. The gradual disintegration of Pakistan reminds me of the slow decomposition of the Austro-Hungarian and Ottoman empires between 1848 and 1914 – it happened in small incremental steps, ever weakening the fabric of their governments and societies until a war was unleashed and they imploded. The danger today is that we cannot afford to let Pakistan become a failed state, not only because it has nuclear weapons but also because of the size of its population, its critical geopolitical positioning and the utter impossibility of occupying its territory to put it back together. North Americans need to be concerned because the outbreak of a civil or regional war in Pakistan would certainly involve India, possibly China, coalition forces in Afghanistan and the Russians. It would disrupt world trade and most likely cause a double-dip recession in the West as consumers close their wallets out of fear. Pakistan’s instability is downplayed on purpose in the popular media because those in charge think that the situation is too complicated to explain to a population base ignorant of international affairs. Imagine the challenge our news editors are going to face when they have to educate everyone on how Pakistan became a problem so “quickly” and why we were not told sooner.

Every economic recovery faces challenges, whether economic or political. In the case of the current recovery from the Great Recession, we did not collectively address many of the structural economic and, indeed, social problems it exposed. We papered them over with cheap government money and hoped for the best, that a future government, or indeed, a future generation, would solve them. Procrastination is not absolution, not given the magnitude of what we have proverbially swept under the rug. Our job-based recovery will continue only as long as the problems described above remain simmering and do not froth over. The chance of all five of these issues remaining contained is not high, but we can probably deal with them individually without throwing the recovery off track. If two or three become critical concurrently then we can expect the recovery to come to an abrupt end.

No comments:

Post a Comment